How to use Orderflow Levels in Crude trading (Part 2)

Example 2: 13/10/23

Hi all,

I had an opportunity to share about humility with a friend on Friday.

“Never be too proud to change bias when the market changes. Otherwise the market will humble you!” ~TToil

In trading,

There are days when market is straight forward. We get our entry, prices move to our desired levels, then we take profit.

There are also days when market moved against our plan/bias. In such cases we had to go for plan B, take some losses or even flip position, then take profit when prices reach our desired level.

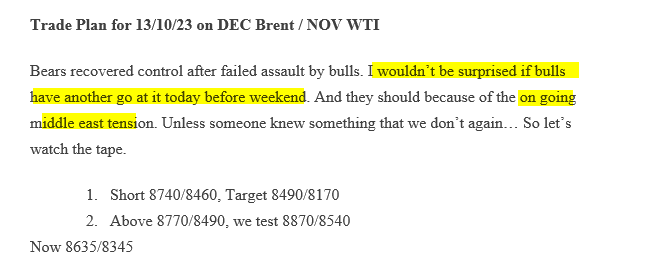

13/10/23 market fitted scenario (2) perfectly, so I thought that it would be beneficial for you guys to learn about my thought process before and during trading hours. I will use DEC Brent futures contract and Singapore Time (GMT+8) for illustration purpose.

DEC Brent settled at 8626, below weekly LIS. Now, bulls failed to stay above that weekly LIS the day before, hence I knew that price action was more in favor of the bears. HOWEVER, I also knew that there is always a risk to go short on a Friday. This is especially so with the uncertainty in the Middle East. With both conflicting “signals” showing up, I knew that the key to winning is good risk management. Hence I sent out a lengthy commentary together with the trade plan.

At 3.30pm, we got our short entry at 8740. It was a nervous short TBH as structures were strong at that point. Nevertheless, a plan is a plan. My only comfort was that I knew what my max loss was - 30 points.

Actually my main consideration at that point wasn’t about whether to take the short. It was rather about …

Keep reading with a 7-day free trial

Subscribe to TTOil’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.